Updated 10/11: added Metro response statement at bottom of post, updated one sentence on targeting "choice riders."

A half-year into Metro and Via's year-long "Mobility on Demand" pilot shows that ride-hail continues to be an expensive way to provide mobility for very few riders.

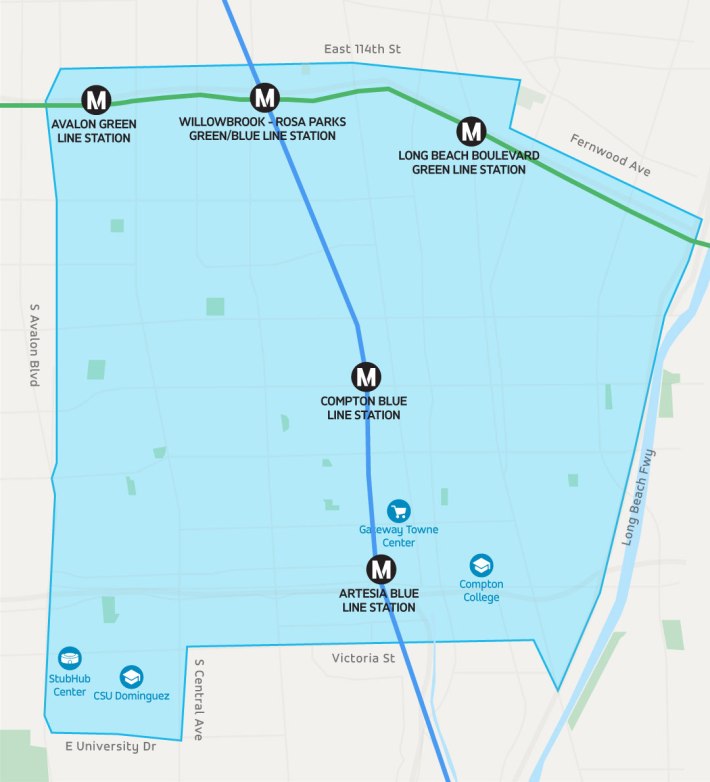

Metro's transit-on-demand pilot launched in January 2019. Metro contracts with Via to provide ride-hail (more or less like Lyft and Uber, but fixed-price) for first/last mile connections to/from several Metro rail/BRT stations. Via's drivers are independent contractors driving their own personal vehicles - though this might need to change under a new state law that takes effect on January 1. The program currently operates from 6 a.m. to 8 p.m. weekdays in three service areas:

- Blue Line Artesia, Compton, and Willowbrook Stations, Green Line Avalon, Willowbrook, and Long Beach Boulevard Stations

- Red/Orange Line North Hollywood Station

- Silver Line El Monte Station

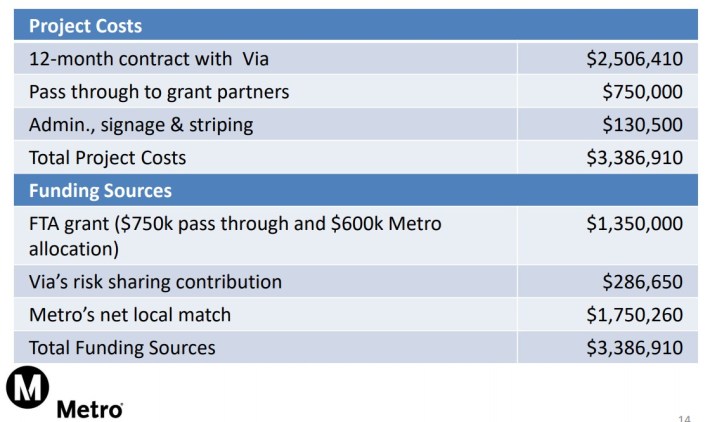

Per the Mobility on Demand Metro staff report, the program's $3.4 million one-year budget is partially funded through a $1.35 million Federal Transit Administration (FTA) demonstration grant, portions of which go to the King County Metro transit agency (Seattle) and to the Eno Center for Transportation, which will publish the results of the L.A. and King County research. Metro's contribution to the first year of the pilot is $1.75 million.

Last month, Metro released its five-page second quarter update report showing the latest statistics for the transit-on-demand pilot.

Half year update on Metro’s Mobility on Demand pilot to provide on-demand pickup/dropoff for 3 Metro stations. Ridership increasing, up to 1675 riders in week 26. 1.8 riders per driver hour, which is below target of 2.5 riders per driver hour.https://t.co/PKe9PO9uj8 pic.twitter.com/panYUgSfkQ

— numble (@numble) October 2, 2019

Metro has been making major changes to the program in a scramble to attract ridership.

Metro is now literally giving away free rides under this pilot. The fixed pricing was initially announced at $1.75 for TAP card holders, $3.75 for non-TAP riders, and free for enrolled low-income riders. Metro's report states that "rides have been free for the second quarter of service and will continue to be free until further notice."

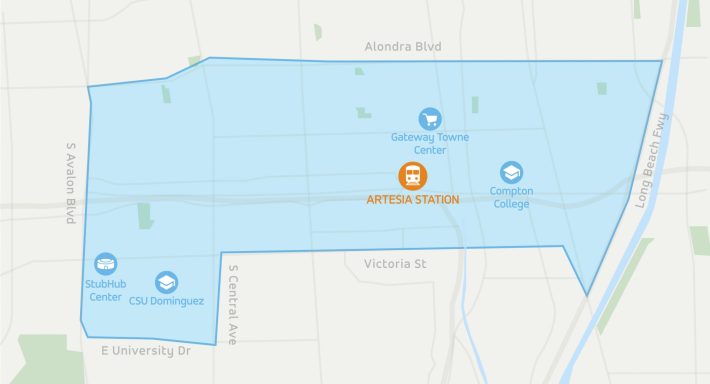

Metro has also greatly expanded service areas. Compare the Artesia service area maps below. (NoHo and El Monte have expanded similarly - see initial maps and current maps.)

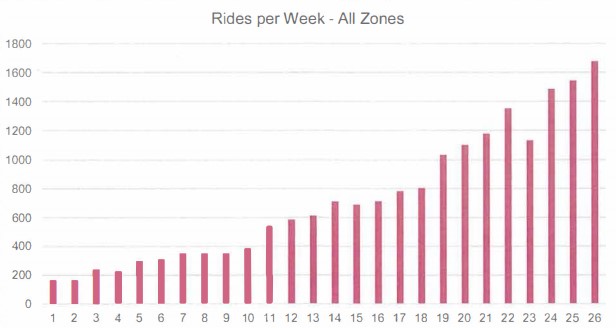

One good sign is that ridership has been growing over the course of the pilot.

The total ridership is still dismal. Giving away free rides, the service got up to 1,675 rides per week. With a $1.75 million Metro expenditure for one year - 260 weekdays in that year, Metro is spending $6,730 per day for these rides. 1,675 rides per week translates to 335 rides per day. 335 rides for $6,730 means that each ride is costing Metro $20.09 (that is just Metro's cost - these also cost FTA and forgo Via's "risk sharing").

That $20 cost is for the one peak week so far - week 26. This means that for overall six months so far, the cost per ride is something more than double that $20. Given the current trend, ridership growth should continue. Though even if it were to double, the cost would only drop to $10/ride - still higher than Metro's system-wide bus ride cost (around $7, given a $1.75 fare and a ~25% fare recovery).

Compare this ridership to a relatively poorly performing Metro line - say the 201 bus, which runs from Koreatown to Glendale. Similar to Mobility on Demand, the 201 bus operates from about 6 a.m. to 8 p.m. weekdays, and provides first/last mile connections to a Metro rail station (Wilshire/Vermont). Unlike the Mobility on Demand pilot, the 201 is not free, but charges $1.75 per ride. Unlike Mobility on Demand's 7-to-9-minute response times, the 201 runs once each hour. According to Metro stats, weekday ridership on the 201 for the first half of 2019 was 983 riders per day on weekdays. Line 201's 983 daily bus riders is roughly triple the 335 daily riders that the Mobility on Demand pilot is serving. With free rides and $1.75 million from Metro (plus FTA funding and Via cost sharing), the newfangled pilot is serving about a third as well as a low-performing bus route.

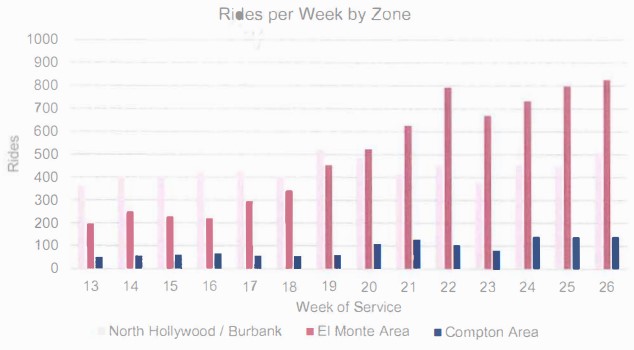

The report breaks down Mobility on Demand ridership by each of the service zones. For the second quarter, Mobility on Demand ridership growth has been mainly in the El Monte service area, which went from ~40 to ~160 rides per day. NoHo ridership largely held steady around 80-100 rides per day. Artesia/Compton grew, but has had minimal ridership all along - at least partially attributable to portions of the Blue Line being closed for refurbishment.

The report indicates that the pilot has failed to serve wheelchair users. "Despite having a dedicated wheelchair accessible vehicle (WAV) positioned at each of the three stations, in the first quarter of service, Via received zero requests for wheelchair accessible vehicle rides." Metro "widely promoted" Mobility on Demand's wheelchair feature, including targeted mailings and calls to Access Services users in the service areas. Per the report, "After this targeted outreach, utilization of the WAV vehicles increased from zero to approximately 10 rides per week, topping 20 rides in the last week of the quarter."

The report also tracks Mobility on Demand's rides per driver hour. The pilot's second quarter showed rides per driver hour climb from 1.12 to 1.8, failing to meet the pilot's goal of 2.5 rides per driver hour. Imagine a Metro bus route that served fewer than two riders per driver hour; it would be canceled.

At only six months, the picture is not complete for Metro and Via's Mobility on Demand pilot. Perhaps the first six months are just a costly loss leader for a program that could conceivably turn itself around. Perhaps ridership will soar, and Metro will actually charge pilot riders the way they do bus riders. It is theoretically possible that (free) pilot ridership could triple to quadruple, making the pilot's peak effectiveness similar to a (fare-paying) low-performing bus route.

Metro is facing a decision in the coming months. The agency needs to decide whether or not to pay $2.5 million for the optional second year of the contract.

This Mobility on Demand pilot appears to be nothing more than a money-losing fad designed to (but failing to) attract picky "choice riders" (deleted based on Metro response - see below) at the expense of current bus and rail riders. If the current performance metrics do not improve very dramatically, then Metro would be foolish to throw good money after bad. Metro boardmembers, already skeptical about independent contractor background checks, should be reluctant to renew a program that could come up against a new state driver contractor law. At a time when Metro is cutting service on crowded rail lines, it looks like it is time for the agency to cut its on-demand losses and instead focus funds on supporting current riders.

Metro's on-demand pilot is not unique in spending a great deal of money to serve very few riders. On-demand services are very costly compared to fixed-route bus service, while consistently serving fewer riders. On-demand drivers have, at best, delivered 2-4 trips per hour per driver – and some pilots achieved less than one passenger trip per vehicle service hour. Poorly performing suburban bus routes still deliver 10-15 rider trips per service hour.

Despite little to no discernible success stories, the on-demand flim-flam - whether including contractor vehicles or a Micro-Transit fleet - continues to flash its shiny new objects in the face of public agencies looking for exciting "innovative" "new mobility" solutions. Perhaps public transit agencies should not look to emulate unprofitable venture capital ride-hail companies. Companies, like Lyft and Uber, known to increase traffic congestion and lose lots of money.

Cupertino, CA, just announced they are launching their own on-demand partnership with Via.

Maybe it will be different this time.

Or maybe transit agencies and elected officials should pay more attention to those lowly buses.

On October 11, SBLA received the following Metro statement responding to the above coverage of the Mobility on Demand program:

It could be helpful to provide the appropriate context for Metro’s partnership with Via. This is a pilot program and experiment that is partially funded by the FTA’s Mobility on Demand (MOD) Sandbox Demonstration Program. One goal of that program is to provide a venue for transit agencies to innovate, explore partnerships, develop new business models, and investigate new technical capabilities within the confines of a pilot. There is no expectation of immediate success. One of the reasons public transit agencies are often reluctant to try new things is that the risk of things not working immediately and being branded a “flop” are very high. If we want to improve public transit, the space to innovate without fear of immediate judgment is critical.

The underlying motivation for Metro’s partnership with Via is to improve access to public transit for the most disadvantaged populations. We are specifically testing whether an on-demand, shared ride that can be requested by smartphone or through a call center, that offers language translation services, and can accommodate customers in wheelchairs, can improve mobility for vulnerable populations. That is not the purpose of a bus. Therefore, the costs of providing this service are not directly comparable to a to a bus, and the ridership of this service is not directly comparable to a low-performing bus route.

In terms of facts, we would like to offer the following corrections/clarifications:

1 - “Metro has been making major changes to the program in a scramble to attract ridership.” In fact, a defining feature of this pilot that was established before it was in operation (when we first applied to the FTA) was enabling Metro to iterate and adjust throughout the duration of the pilot.2 - “Metro is now literally giving away free rides under this pilot.” The service is not free. Since this can only be used as a first-last mile service connecting to transit, customers must pay to use transit. The Via ride is essentially a transfer.3 - “With a $1.75M Metro expenditure for one year – 260 weekdays in that year, Metro is spending $6,730 per day for these rides. 1,675 rides per week translates to 335 rides per day…” Metro’s contract with Via states that we pay for driver hours as they are incurred. We are not paying a flat-rate contract amount — we are paying per driver hour. Secondly, there was no mention of the fact that Via has contributed $287,000 toward the contract cost. Thirdly, our ridership numbers in September, along with the incurred driver hours, put our costs closer to a $14.50 subsidy.4 - The cost analysis fails to recognize that this is a fully-loaded cost that includes on-demand wheelchair accessible vehicle service, which is historically expensive for agencies to provide.5 - “This Mobility on Demand pilot appears to be nothing more than a money-losing fad designed to (but failing to) attract picky “choice riders” at the expense of current bus and rail riders.” The opposite is true. The pilot was designed explicitly to test the provision of a new technology-enabled service to low-income, high-minority populations that may not have smartphones or data plans or may need extra accommodation.6 - “Despite little to no discernible success stories….” This program is meeting or exceeding all but one Key Performance Indicator (KPI) and we expect it to meet that one soon. Moreover, our pilot partners in Seattle at King County Metro piloting “Via to Transit” are seeing even greater success. They have provided more than 100,00 rides to date, 340 WAV rides, 900 rides/a day and growing, and are seeing 4 rides/vehicle/hour with 8-minute waits.