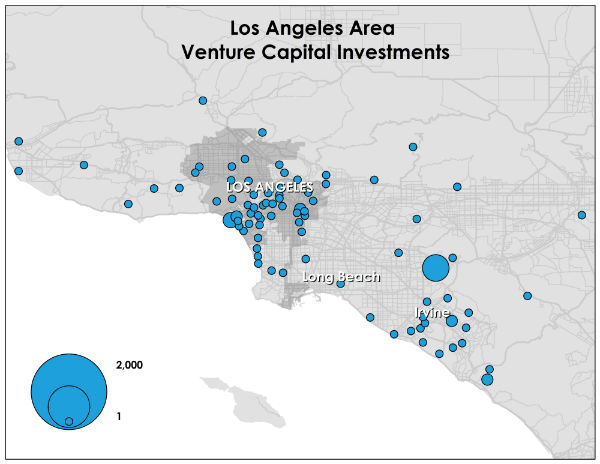

In a brilliant series examining venture capital (VC) investments--money largely invested in technology-based sectors--urban guru Richard Florida has taken data from Dow Jones and broken it down in maps and context. The macro-point is--in Floridian style--quite simple: though San Francisco/San Jose still account for an enormous chunk of VC investment, said investment is spreading into urban neighborhoods.

And the data encourages me to pose a question that I seem to pose all too often: Where, oh where, is Long Beach?

As always, the Shadow of Los Angeles paired with the White Glare of Orange County proves Long Beach to be the hard-to-look at contrasted center. In this case, the shadow of West L.A.'s massive boom in VC investment--over $450M from Santa Monica to Westwood alone--and the glare of East Anaheim's similar boom--a staggering $531M, the largest single core of VC investment in the entirety of Southern California.

This shift of the high-tech sector from suburban to urban is, as Florida points out, antithetical to the well-known Brookings report a decade ago which predicted jobs in that sector would reside in self-contained, high-tech suburban places like Irvine--which actually fell behind the more dense areas of San Diego, Anaheim, and L.A./Santa Monica in amount of VC investments.

So where is the LBC?

Is it at the over-$100M with comparable cities in size--Portland, Cleveland, Denver--or industrial strength--Detroit, Baltimore, Dallas? Maybe?

Not even a tenth.

Long Beach hovers at a paltry $9.52M in 2011, which was gathered for a single deal; the data was provided by Florida.

"I am not sure why Long Beach has little investment," Florida said. "I think it has all the assets too. My hunch is that it takes more than one startup to make this happen."

I share his confusion: For one, the growing disinterest in Irvine could be explained by its utter lack of transit and being walkable; its Walkscore currently sits at a sad 54 compared to Long Beach's 66. This is, amongst young professionals, unwelcoming since where they live and work become cogs in how they happily function: driving everywhere all the time is not as jealous-inducing as someone who is able to enjoy a plethora of restaurants and take their food to a park on their lunch break without breaking a sweat.

This could partially explain downtown Santa Monica's enormously large VC investment, which is the second-largest concentration in Southern California: its overall Walkscore is 82, with its downtown core--which harvests some $286M in VC investment monies--holding an astounding 95 (still above Long Beach's highest-marking area, Downtown, at 89). This makes almost any point about traffic issues along Silicon Beach somewhat moot. And even more, when paired with the fact that they have a shopping district that isn't run-of-the-mill nearby--something we all know Downtown Long Beach, probably the most viable space for a tech core if we were to have one, severely lacks--it is no wonder people want to work there as well as invest there.

This isn't to say there haven't been talks about growing Long Beach's tech sector--often to the extent of being overtly optimistic in nature.

John Grefe of Long Beach Tech--a non-profit dedicated to encouraging profit-oriented technology startups--noted in an op-ed introducing a techy focused column for the Long Beach Business Journal that Long Beach has a "technology footprint [that] is growing fast." However, his only direct proof was the mention of a mobile app developed in the Zaferia District on the East Side and mention of CSULB tech students (which doesn't necessarily equate to tech startups right here in town).

Eric Gray followed up with the second article in the column series in a similar fashion: equally optimistic but more specific, noting cheaper rent amongst a list of other pluses.

"I believe our city is well positioned to attract a large swath of technology businesses," he said. "Not only are we centrally located between Orange County and Los Angeles, but we boast better weather[, traffic, walkability, and transit than other competitors]."

Ultimately, this comes down to a different discussion: Addressing reasons as to why Long Beach could be a great space to harness one's investment is a tad redundant. More than defending its capability at hosting VC investments, the question we need to address is more city-reflective than deflective: Why are we missing out on the SoCal tech boom?