ed’s note: This week, we’re featuring a short series of articles from our board member Juan Matute on what he’s thinking about technology and transportation. His first thoughts were on vehicle connectivity versus automation.

A lot has been going on with Transportation Network Companies since my October 2013 conversation with Damien Newton. Damien and I talked the month after the California Public Utilities Commission created a legal pathway for companies like Uber, Lyft, and Sidecar to exist in California.

Above all, the services have been growing, both inside and outside California.

Transportation Network Company Growth by the Numbers - U.S. Cities and Valuation

Uber | Lyft | Sidecar | |

October 2013 | 25 cities (worth $3.5B) | 15 cities (worth $275M) | 6 cities |

December 2013 | 29 cities (worth $3.5B) | 18 cities (worth $275M) | 6 cities |

March 2014 | 36 cities (worth $3.5B) | 20 cities (worth $700M) | 8 cities |

UberX announced a 20% price drop in Los Angeles and other markets. Liability issues persist and will take a while to resolve. Lyft started the Peer2Peer Rideshare Insurance Coalition to help work through some of the issues.

I still believe the primary benefit of these new companies is that they can be a scalable platform for rideshare. The greatest promise of each of these services is to bring large numbers of drivers and passengers together on a single platform, which then makes passenger matching and shared rides that are ancillary to a driver's intended trip more likely.

The secondary benefit to the services is to those individuals looking to supplement their income. Qualified unemployed and underemployed people, with cars, can earn extra income. Between increasing student debt loads and a long-term sluggish economy, economic conditions are ripe for supplemental income opportunities. I've talked to many UberX and Lyft drivers who saw the opportunity as a safety net.

Having a lot of drivers and passengers on a single platform is good for transportation. Technology can facilitate shared trips. With pre-specified destinations, a passenger may take a ride that a driver wanted to take anyway. With passenger matching and fare splitting, two or more passengers could match from nearby origins to similar destinations. With more trips, more matching takes place, resulting in more efficiency and economy.

However, having too many drivers or passengers can bring imbalance to the systems.

Too many passengers results in surge (UberX) or primetime (Lyft) pricing, which is designed to temporarily quell demand and bring more drivers onto the system in order to restore balance. Too many passengers is mostly a problem that can be alleviated in the short-run.

Having too many drivers on the system also brings an imbalance, but one that can be harder to remedy in the short run. This can be good for passengers - who wait less time for their ride to show up and are less likely to experience demand-based price increases. However, having too many drivers can be bad for drivers, who wait longer between ride requests and earn less per hour. Sidecar now offers drivers the option to offer rides at a lower rate, reducing wait times but also earnings.

The problem of too many drivers can be alleviated in the short run if drivers decide to stop offering rides and go home. However, this response ignores the role of these services in supplementing incomes. Drivers who don't mind earning less will continue to offer rides. Drivers who don't fully account for the costs they incur to own and operate their vehicle, including the additional costs of wear and tear on their cars, may stick it out for lower expected hourly earnings than they would if they accounted for all costs. Drivers who have been on the platforms for many months will see their incomes become less stable.

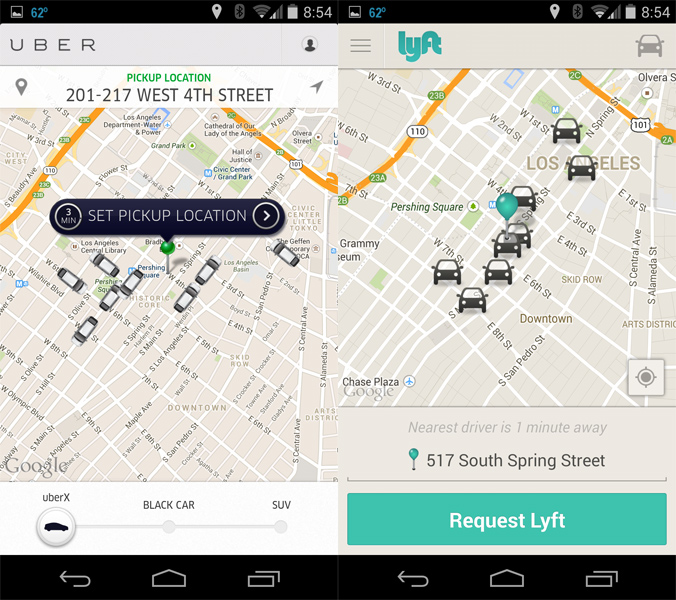

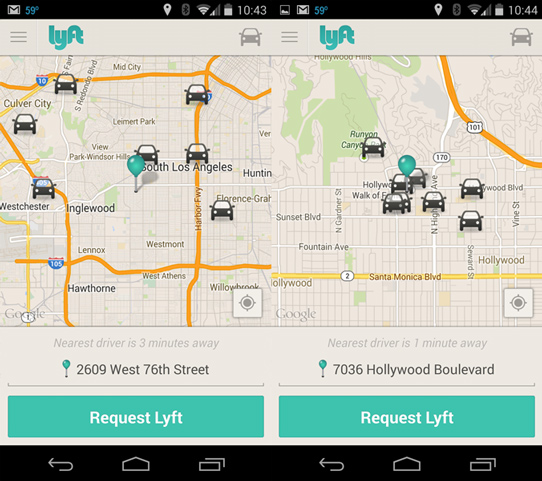

Anecdotal evidence suggests the supply of Uber and Lyft drivers has outpaced demand in Los Angeles in recent weeks. As a transportation geek, I sometimes conduct a non-scientific study of where UberX and Lyft drivers are to see how they're covering different times (span of service) and areas. It's promising to see expansion to other areas of Los Angeles that weren't served last year. I've also noticed greater concentrations of vehicles in popular areas during recent weeks, which may indicate a growing number of drivers relative to passengers

I hope that, if there is an issue with driver oversupply, it's a short term issue that's remedied as even more passengers come onto the platforms. I believe that the long-term viability of these companies is dependent on keeping both drivers and passengers happy, as the services tout community and friendly conversation with a driver among their advantages. I think it's in the best interest of the three major players to avoid becoming a commodity product competing on price. The city of Seattle is looking to limit each of services to 150 drivers at any given time. Such an effort may help drivers in the short-run, but also eliminate the promise of a scalable ridesharing platform in the long-run.

If you're interested, you can sign up to be an UberX driver in Los Angeles.

We’ll be talking about transportation network companies at UCLA’s Digital Cities: Smarter Transportation Forum, downtown on Thursday, March 20th. Streetsblog readers can register for $129 using discount code “sbla”.