![Metro's FY2016 budget breakdown - roughly one third image via Metro April handout [PDF]](https://lede-admin.la.streetsblog.org/wp-content/uploads/sites/50/2015/04/Budgetbreakdownmetro.png?w=420)

At 10 a.m. tomorrow, Saturday, April 25, the Metro Board of Directors is hosting a public meeting to receive input on the agency's proposed budget for Fiscal Year 2016. It is expected that the Board of Directors will approve the budget at their May meeting.

The agenda for tomorrow is slim, with no supporting materials. Since January, though, at Metro's monthly Finance, Budget and Audit Committee meetings there have been a number of presentations outlining what to expect in the upcoming budget:

- January: FY16 Budget Planning Parameters - report [PDF] handout [PDF]

- February: FY16 Capital Program Budget - report [PDF] handout [PDF]

- March: FY16 Operations Budget - report [PDF]

- April: FY16 Budget (overall - focused on staffing) - report [PDF] handout [PDF]

- April: FY16 Budget (public engagement - not particularly informative) - report [PDF] handout [PDF]

The budget is, of course, massively important in showing what an agency actually prioritizes. It is also a massively opaque document and not a great opportunity for the public to easily leverage changes. I also cannot claim to be any kind of budgetary expert. In the past I mostly paid attention to the 0.0 percent of the Metro budget that went to walking and bicycling. Nonetheless, I've been paying some attention to the bigger picture this year and I'll pass on some highlights.

Metro's proposed FY16 budget totals $5.568 billion in expenditures. This is a $53.4 million (one percent) increase from the $5.515 billion in the FY15 budget. The $5.6 billion breaks into roughly thirds:

- Engineering and Construction: $1.84 billion (33.1 percent)

- Operations: $1.73 billion (31.0 percent)

- Support Services - includes financing: $1.07 billion (28.6 percent)

Planning, development, and congestion reduction programs constitute the other 7.2 percent. These figures are based on the April handout [PDF] with percentages calculated here.

The overall revenue picture, as far as I can tell, is less clear. I haven't found an overall income breakdown.

Perhaps the most contentious item on the revenue side would be fares. Metro's overall FY16 budget assumes "no adjustments in fare structure from the September 15, 2014 fare increase" including maintaining the current student fare, which was frozen at that time. The FY16 estimated fare revenue of $363.2 million, a 3.5 percent increase from FY15's $351.1 million, is due to a full year of the fare increase, plus some additional ridership increase from the Expo Phase 2 and Gold line Foothill Extension rail lines expected to open in early to mid-2016.

Overall the FY16 budget assumes no increase in bus service. The only additional transit service planned will be the new Expo and Gold Line extensions.

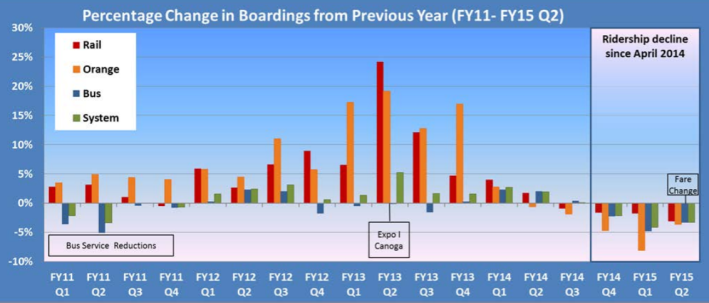

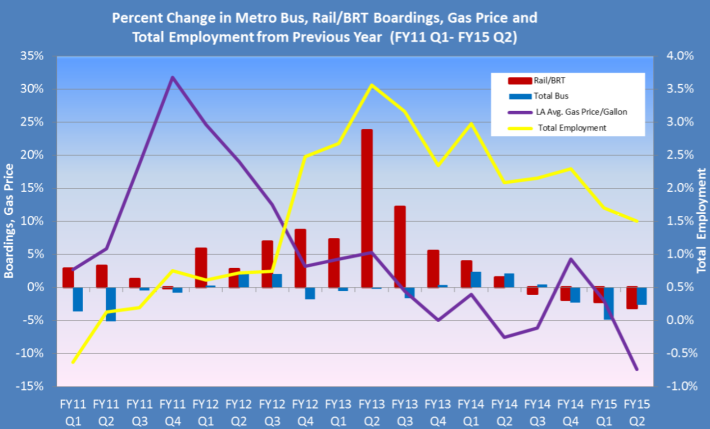

The FY16 budget assumes that Metro ridership will continue to decline by 5 percent in FY16. Ridership declined by 4 percent in FY15. See the very interesting March handout [PDF] for Metro staff's extensive work in finding correlations, and lack thereof, between ridership, employment, gas prices, car sales, etc. It appears the only highly important factor they didn't examine (or perhaps report) was the correlation between ridership and fare increases.

In total, though, for FY15 and FY16, fare revenue only accounts for 6.4 percent of Metro's overall revenue. Much more of the agency's income is from sales taxes and other governmental sources.

There are also bigger trends at play here, that I am not a strong enough fiscal sleuth to nail down today. From here, I venture out of Metro staff reports into speculative territory, not based on the immediate FY16 budget, but on some remarks and observations including portions of the recent APTA audit.

Overall Metro continues to invest aggressively in rail construction, resulting in greater capital costs (now) and greater financing costs (later) with minimal overall gains in transit service or ridership. Rail is expanding while bus service is being cut, with overall service hours actually declining. Even Metro figures show that ridership has been in decline since prior to the recent fare increase, which appears to have exacerbated the decline.

The agency's fiscal balance is precarious in the longer time horizon. Massive construction sucks the air out of the room for all other agency functions. Heavy capital expenditures put agency finances into a "structural deficit" which former CEO Art Leahy and others have asserted means fare increases will be needed as early as mid-2016.

It gets even worse when sales tax revenue does not keep pace with projections; this occurs when the economy slows down. When agency expenditures outpace agency revenues, riders suffer from service cuts and fare increases. This results in an overall spiral of declining ridership, declining fare income, and further fare increases and service cuts. These chickens do not appear to be coming home to roost imminently, but, over time, they may.

Nobody predicted the decline in driving underway currently. It's possible that demographic trends, gas prices, technology, or something else unforeseen will prove my fears wrong.

I do not have all the answers, but I think that one overlooked agency liability is maintaining (and continuing to expand) huge amounts of free parking - see the APTA review recommendations on this. Maybe Metro's new CEO Phil Washington can steer the agency into more prudent and effective territory.

Passage of an additional Measure R2 sales tax could paper over current trends, but if it over-promises massive capital expansion, the hole that it digs may be even deeper than the current one. There is no guarantee that the electorate will pass any future measure, though.

Streetsblog L.A. will continue to track and report on the Metro budget as it nears its anticipated May approval.