As Congress mulls over solutions to the nation's transportation funding gap, with an eye to passing new infrastructure legislation to reverse the rising unemployment rate, Rep. Pete DeFazio's (D-OR) proposed tax on oil futures is picking up new fans in high places.

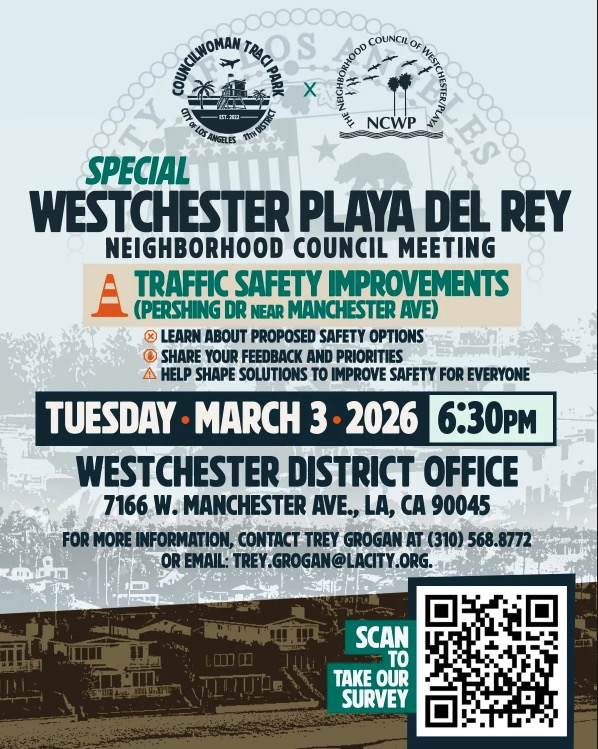

Rep. Pete DeFazio (D-OR) (Photo: UPI)

Rep. Pete DeFazio (D-OR) (Photo: UPI)DeFazio's

legislation would levy a 0.2 percent fee on oil futures and a 0.5

percent fee on oil futures options, and a broader version introduced

earlier this year would impose a 0.25 percent tax on all stock trades

-- a compelling option for a White House wary of voter frustration with

the financial bailout and in need of new revenue-raising ideas.

But

DeFazio's broader transaction-tax bill has attracted a flurry of

dissent from the investment industry. As the chief lobbyist for the

Financial Services Roundtable told the Financial Times in August:

We vigorously oppose a tax on the industry. The financial services industryis a leading sector around the world in producing jobs and providingpeople with goods and services they demand. A punitive tax wouldunnecessarily restrict the industry, harm shareholders, and ultimatelyweaken a key segment in the world economy.

The pension industry is reportedly just as cool on the proposal, and an online petition filed against the broader DeFazio bill lists more than 58,000 signatories. In a pithy summary of Wall Street's perspective on the bill, one investment adviser titled his blog on the issue "Financial Transaction Taxes Would Cause Stock Market Crash."

Of

course, it's not surprising that Wall Street would resist the notion of

paying more for stock trades, which can be conducted at superhuman

rates thanks to computer programs used by banks and hedge funds. But would limiting DeFazio's tax to speculative trades on oil, widely blamed for last year's run-up in gas prices, arouse as much opposition?

Perhaps

not. Still much depends on the enforcement of the exemption the bill

carves out for "legitimate" oil futures trades conducted by truckers,

airlines, and other transportation interests that have a business

interesting in protecting against sudden shifts in oil prices.

More

than 80 percent of oil futures contracts on the New York Mercantile

Exchange were held by financial firms "speculating for their clients or

for themselves," according to a 2008 Washington Post investigation.

It's the drawing of that line between firms' clients and the firms

themselves that could hold the key to the tax's effectiveness -- and to

its political future.