Next week, Missouri voters will decide on Amendment 7 -- a three-quarter-cent sales tax hike to pay for transportation projects that would be the largest tax increase in the state's history. Construction industry groups have poured millions into convincing Missourians to pay $5.4 billion over the next 10 years. Will they bite?

A coalition of pro-transit forces is urging them not to. Thomas Shrout, a long-time St. Louis transit advocate, is heading the opposition, a group called Missourians for Better Transportation Solutions. Shrout says the tax fails on a number of levels.

For one, 85 percent of the money would be spent on roads. Only 7 percent would go to transit and a small portion would go toward local governments.

"It’s just out of proportion," said Shrout.

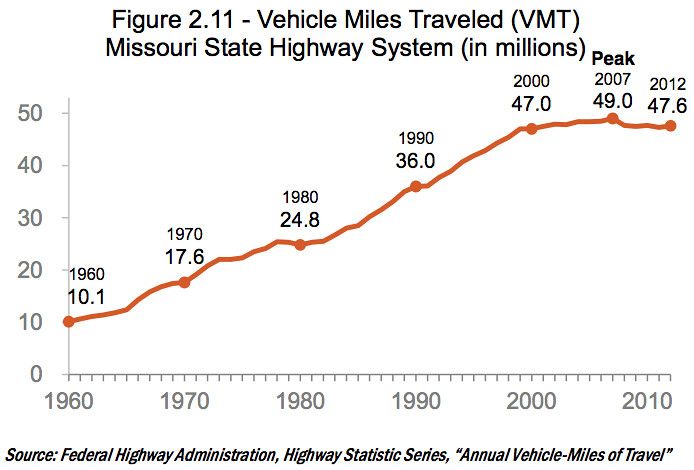

Highway capacity in slow-growing Missouri is already abundant. Compared to other American cities, Kansas City and St. Louis rank near the top in highway miles per capita. Driving has been declining nationwide and Missouri's population grew less than 1 percent over the last 13 years.

So why the push to raise taxes to build new roads? Follow the money. “Just about every major [engineering and construction] firm in the country has given to the Yes campaign,” Shrout told Streetsblog.

Even if Missouri's project list wasn't larded with highways, raising the gas tax would be a far fairer revenue source. But state legislators have instead settled on the regressive sales tax model.

That means, if Amendment 7 passes, the state's poorest residents -- whether they drive or not -- will pay a larger share of their income than the state's affluent residents. A study by the Institute on Taxation and Economic Policy found that the poorest 20 percent of Missouri residents spend 5.9 percent of their income on sales and excise taxes. Meanwhile the richest 1 percent pay just 0.9 percent.

Gasoline and diesel purchases don't carry a sales tax. Neither do truck sales, meaning even though trucks cause the most damage to roads, businesses that use trucks would be exempt from paying for those roads in Missouri.

A provision of the amendment would also forbid the state from raising the gas tax or issuing new tolls while the tax is in place.

Missouri's sales tax rate is already the 14th highest in the country. A significant increase could potentially undermine consumer spending and hurt the state's economy. It could also hurt transit projects, which are usually funded by local sales taxes. If Amendment 7 passes, it would raise the sales tax to 9.5 percent in St. Louis. That could jeopardize any future attempt to expand light rail, for example, by raising the sales tax.

The editorial board of the St. Louis Post Dispatch has called the tax proposal "an abomination" and "the wrong tax at the wrong time and in some ways, for the wrong purposes." The paper noted that the proposed sales tax hike follows an income tax decrease that will slash services and disproportionately benefit the state's wealthiest.

"If Amendment 7 passes, Missourians can drive better roads to crummier schools," they wrote.

Even so, some active transportation groups -- but not all -- have lined up behind the proposal, because of some promises the state has made to fund specific projects. The Missouri Bike Federation came out in favor because it would represent the state's first dedicated funding for biking and walking, and the state promised funding for a number of trail projects. Meanwhile, TrailNet in St. Louis, a fairly large trails advocacy group, is opposed.

It remains to be seen how opposition efforts will play out against the $2.5 million the construction industry has already poured into convincing voters the new tax will create jobs and improve safety. (They have an additional $1.7 million remaining in their coffers for the "final push," the Associated Press reports.) Missourians for Better Transportation Solutions has raised only $26,000 -- enough for a single mailer. Even so, a number of politicians, including a large portion of the St. Louis Board of Aldermen, have allied themselves with the opposition.

In the Kansas City Star this week, State Senator John Lamping called the proposal a "grab" by "special interest groups."

"The tax is cynical," he said. "The proponents assume you’re not paying attention."

It will be interesting to see if they're right.