(Chart: Oregon DOT)

(Chart: Oregon DOT)The prospect of an eventual move away from the gas tax and towards a fee on vehicle miles traveled (VMT) has sparked consternation from some well-known bloggers this week, with Matt Yglesias asserting that "a VMT [tax] has no advantages whatsoever over higher gasoline taxes" and Andrew Samwick suggesting that declining fuel tax revenues mean that tax rates need to go even higher.

Leaving aside the political challenges

facing a 10-cent gas tax increase, as suggested last year by the

National Commission on Surface Transportation Infrastructure Financing

(a similar panel of experts called for a gradual 40-cent hike

in 2008), significant questions surround the gas tax's viability as a

long-term revenue raiser for infrastructure improvements -- regardless

of how high it goes.

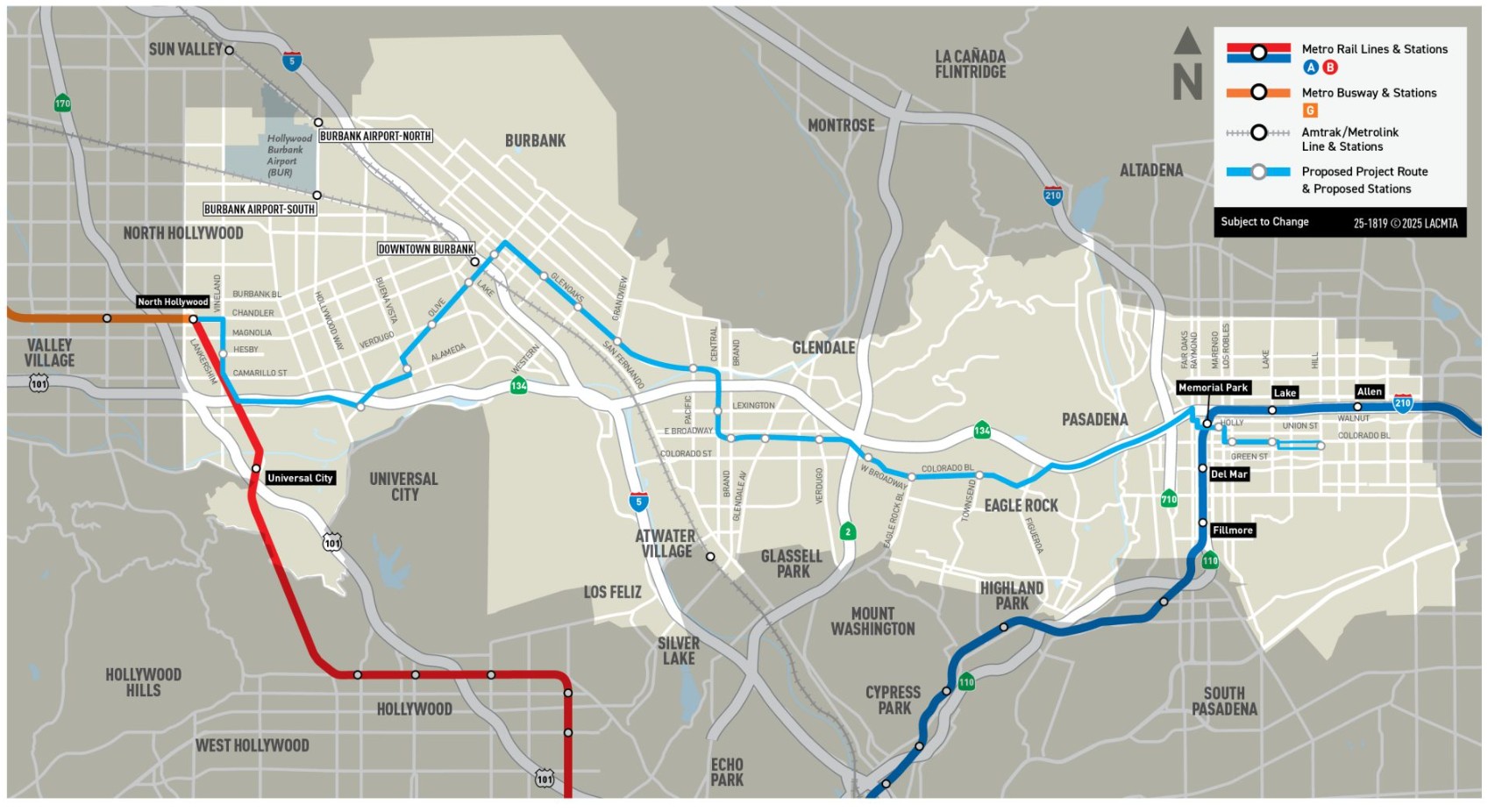

Take the example of Oregon, the

first state to levy a fuel tax in the year 1919. Now the state's gas

tax ranks 21st in the nation, but it began planning ahead for a VMT tax

nine years ago after repeated attempts to raise fuel fees ran into

political opposition. In its final report on the state's "road user fee

pilot program," the Oregon DOT noted that gas tax revenue couldn't keep

pace with the rise in fuel-efficient autos (see the above chart).

The

state DOT's report, written by James Whitty of the innovative

partnerships office, took a candid look at the upsides and downsides of

the gas tax (emphasis mine):

From

the standpoint of tax policy, the gas tax is close to perfection.

Nearly all the hallmarks of good tax policy can be found in Oregon’s

efficient gas tax collection system. The gas tax has the inherent flaw,

however, of lacking a direct nexus to road use. As a

consequence of this flaw, it will become obvious in 10-15 years, if not

earlier, that the gas tax has failed its originally intended purpose as

a reliable source of revenue for the state's road system.

That

absence of a "direct nexus to road use" is a concept not easily

understood by many Americans, especially drivers long inundated with

misleading claims that the gas tax constitutes a user fee. As Ryan

Avent has explained on this page, a user fee assumes that everyone on the road pays for the time they spend and the burden they place on it.

But

while 25 gallons of taxed gas will last for an estimated 725 miles in a

2010 Ford Escape hybrid SUV (at a combined 29 miles per gallon), the

lighter 2010 Ford Mustang (estimated at 19 miles per gallon) would go

just 425 miles while paying the same amount of gas tax. The heavier car

ends up putting more stress on the road while paying less for it. Is

that an equitable system of maintaining the transportation network?

As

Oregon discovered with its VMT pilot program, the gas tax and a mileage

fee can be charged at the same time by tallying miles traveled at the

pump based on a system of local zones, similar to what some areas use

for taxicab charges. As the website Portland Transport showed in a pictorial post from 2007, congestion-pricing features could be added to customer receipts in a separate column from the VMT tax and gas fees.

So

perhaps the question isn't whether to sell the public on a viable VMT

tax as a replacement for the gas tax, but how to make both policy tools

work effectively in tandem.

As for the civil-liberties ramifications of VMT charging, it's hard to see American drivers who have already embraced the Garmin GPS

and the Onstar navigation system -- which connects you with a live

"advisor" -- rejecting en masse one more device in their vehicles.

Especially if that device helps fund transportation more equitably.