Transportation Funding

Reasons Why You Should Vote for Metro’s Sales Tax

Stay in touch

Sign up for our free newsletter

More from Streetsblog Los Angeles

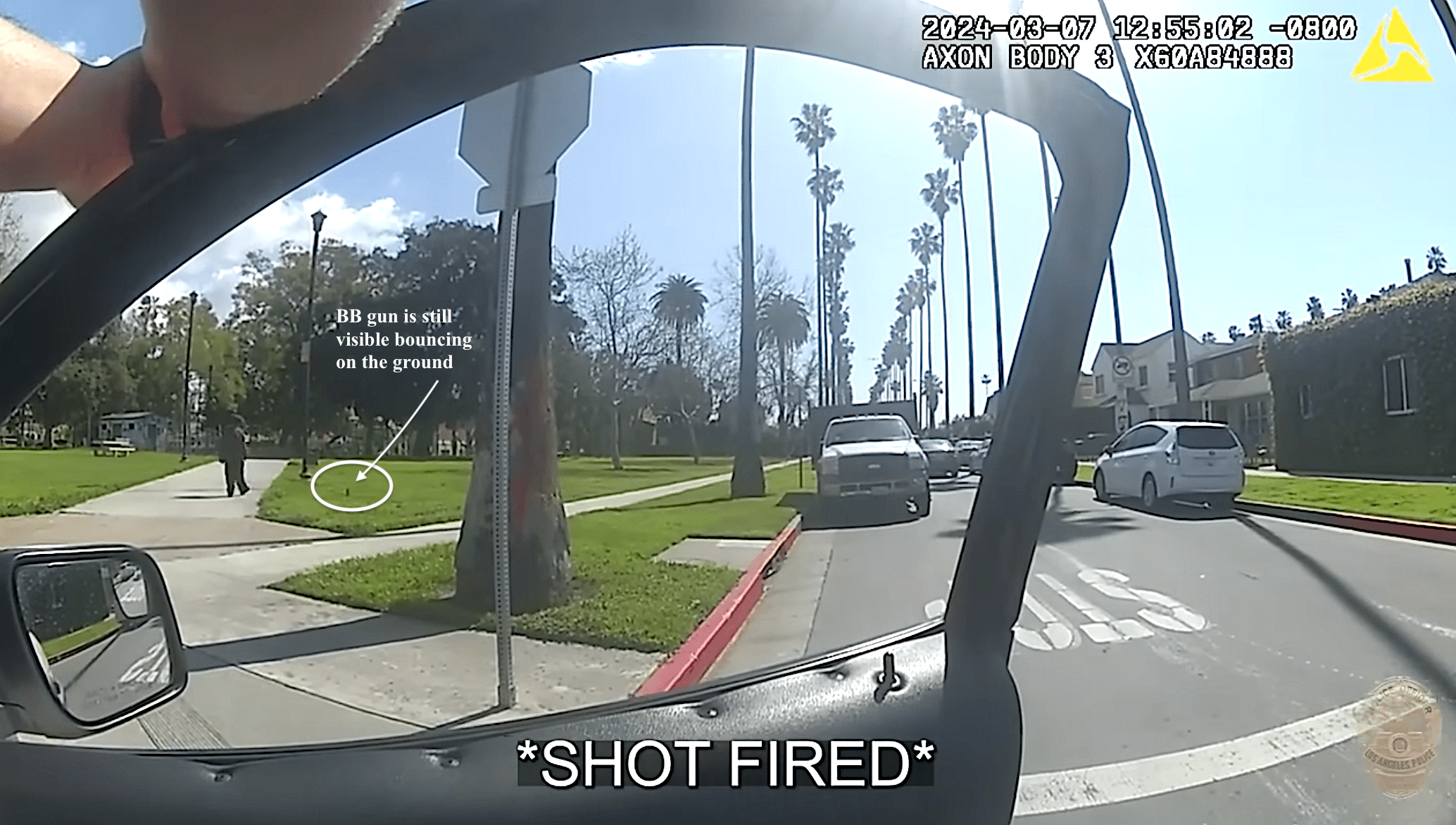

LAPD shoots, strikes unarmed unhoused man as he walks away from them at Chesterfield Square Park

LAPD's critical incident briefing shows - but does not mention - that two of the three shots fired at 35yo Jose Robles were fired at Robles' back.

Metro Committee Approves 710 Freeway Plan with Reduced Widening and “No Known Displacements”

Metro's new 710 Freeway plan is definitely multimodal, definitely adds new freeway lanes, and probably won't demolish any homes or businesses

Automated Enforcement Coming Soon to a Bus Lane Near You

Metro is already installing on-bus cameras. Soon comes testing, outreach, then warning tickets. Wilshire/5th/6th and La Brea will be the first bus routes in the bus lane enforcement program.